A brief history of AHMSA

Altos Hornos de México, from privatization to financial struggles, and potential tribal funding.

In the northern region of Mexico, the steel industry witnessed a transformation with the privatization of Altos Hornos de México (AHMSA) and SICARTSA in the early 1990s. Recently, news surfaced that the Kickapoo tribe could be the potential savior for the struggling steel company.

Ownership and acquisition

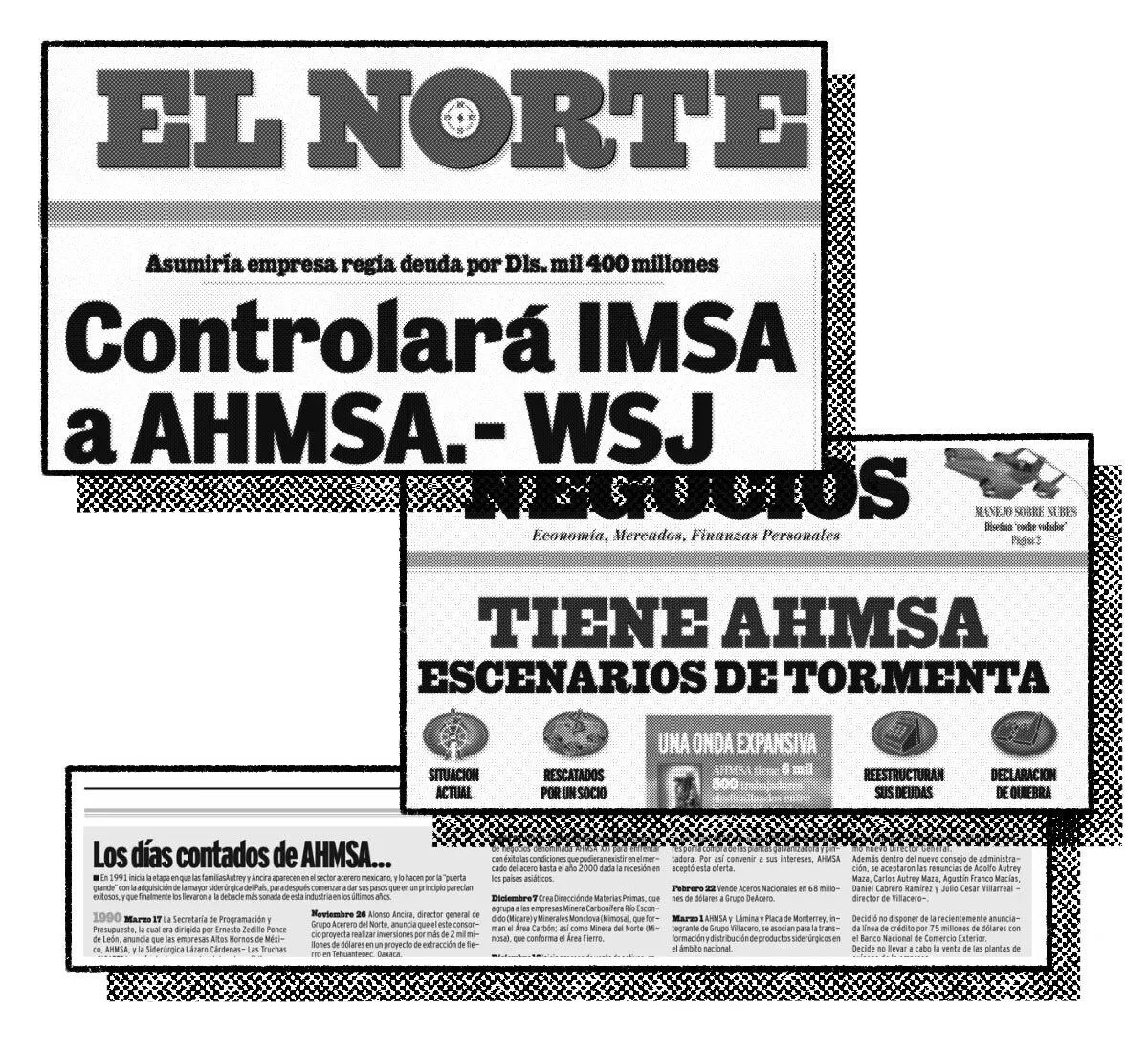

AHMSA and SICARTSA were two government-controlled steel mills that were privatized in March 1990.

Grupo Acerero del Norte, led by Xavier Autrey and Alonso Ancira, acquired AHMSA in November 1991.

Don’t forget to subscribe to our weekly newsletter, it’s free!

Financial situation and investments

AHMSA faced financial difficulties in the late '90s due to the Asian financial crisis, leading to a suspension of payments.

The Autrey brothers' business empire, including Casa Autrey, faced a crisis in the late '90s due to poor decisions and economic troubles.

AHMSA invested in various initiatives, such as creating a nature reserve, supporting the local baseball team, and expanding the Monclova airport.

AHMSA's new owners implemented cost-cutting measures and achieved profitability by reducing operating costs and increasing efficiency.

Potential funding source

El País reported that the funds to revive AHMSA, amounting to over $1 billion USD, could potentially come from the Kickapoo tribe.

Business expansion and diversification

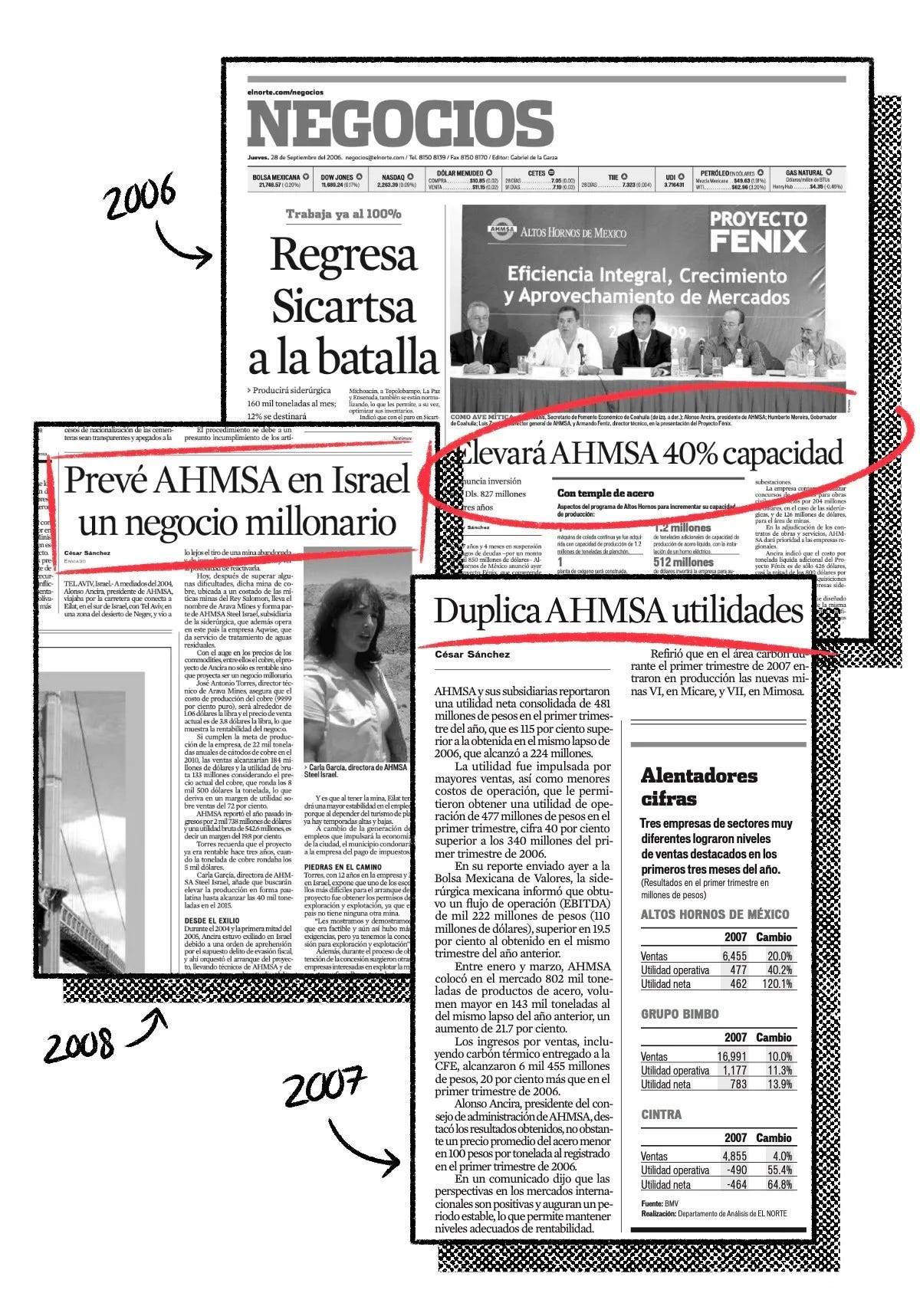

AHMSA had plans to invest around $800 million USD in modernization to improve capacity and efficiency.

Casa Autrey diversified its business by distributing various products beyond pharmaceuticals, but faced challenges with shrinking profit margins.

AHMSA's new owners, Grupo Acerero del Norte, aimed to make the company more efficient and competitive by reducing unnecessary expenses.

Controversial business deal

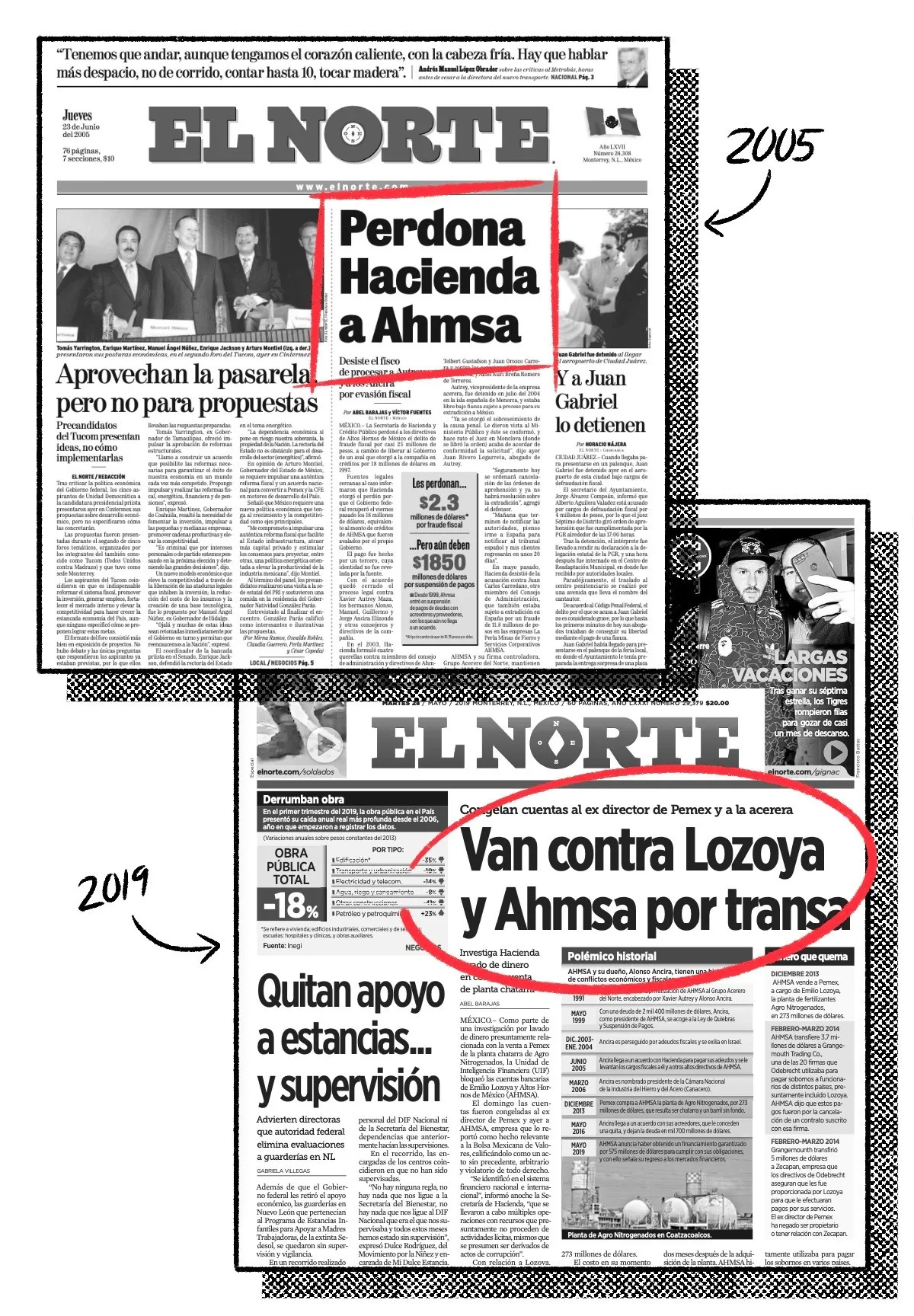

AHMSA agreed with IMSA to transfer the debt and control of the company, but later reversed the deal, citing a better offer from a Spanish company.

Legal and regulatory issue

The old Suspension of Payments Law, which allowed AHMSA to remain under the administration of its debtors, caused controversy for favoring debtors.

Economic impact and market conditions

AHMSA's financial situation was affected by the cyclical nature of the steel business, with market conditions influencing steel prices.

The Asian financial crisis led to a collapse in steel prices and financial difficulties for AHMSA in the late '90s.

Part 2

From soaring successes to deep setbacks.

Altos Hornos de México (AHMSA) has been a towering presence in Mexico's steel industry, commanding significant market share and employing thousands of workers. However, behind its impressive facade lies a saga filled with legal battles, financial struggles, and a series of unexpected turns that have kept the nation's eyes fixed on its fate.

Financial situation

AHMSA stopped paying its obligations and entered into a payment suspension for almost 15 years.

In 2005, it reported an EBITDA of $538 million dollars.

In 2016, they agreed to capitalize 70% of the debt in exchange for up to 20% of the company's shares, and the remaining amount would be paid within a maximum of three years.

In 2019, they obtained a $575 million dollar credit from Cargill Financial to pay off their debt.

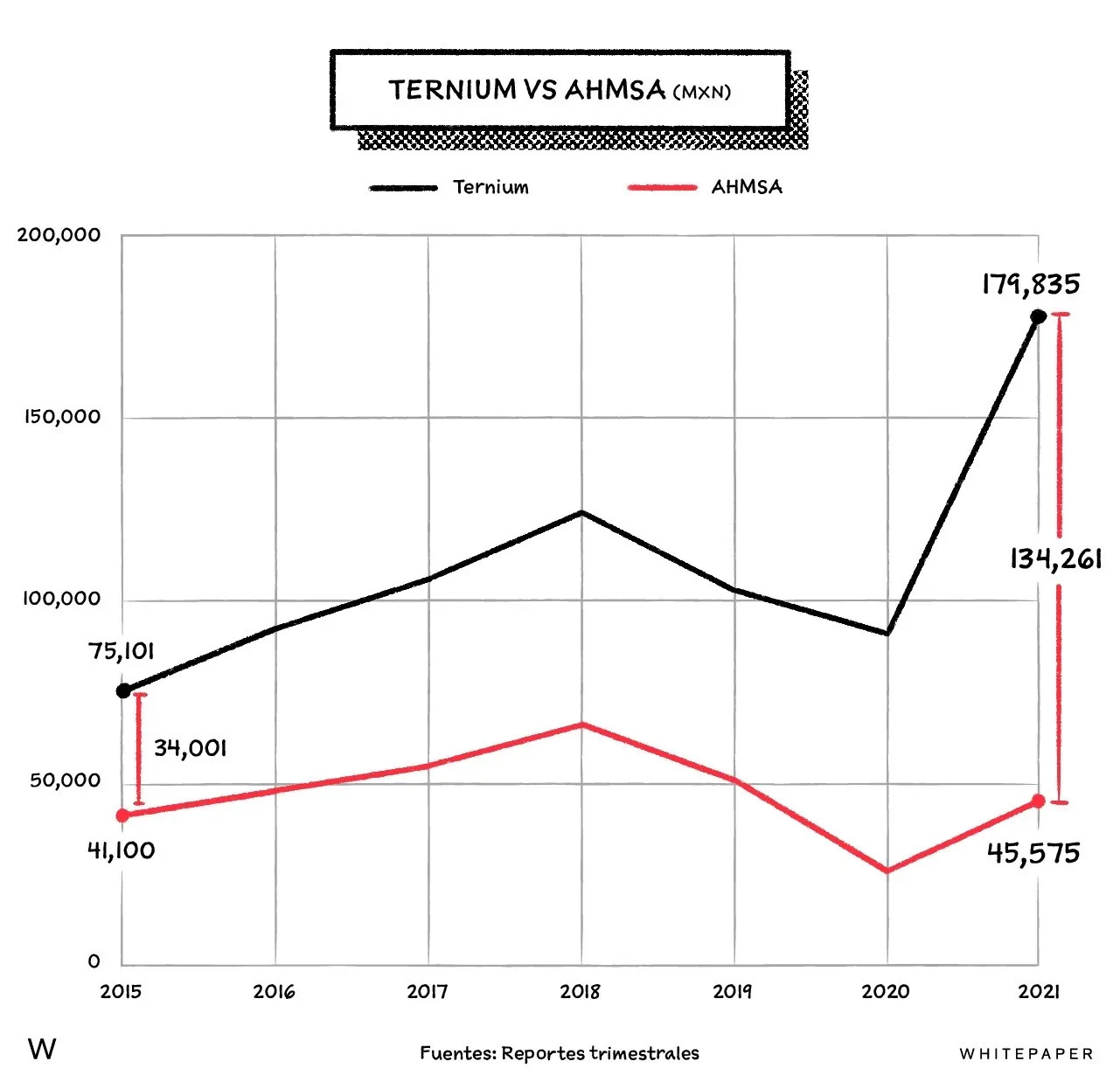

In 2021, the sales figure decreased to $45.5 billion pesos, but the EBITDA was still over $8 billion pesos.

Don’t forget to subscribe to our weekly newsletter, it’s free!

Legal issues

In May 2019, the financial intelligence unit froze AHMSA's accounts and issued an arrest warrant against Alonso Ancira.

In January 2021, AHMSA returned $219 million dollars to PEMEX in exchange for Ancira's release.

Acquisition and ownership

In March 2023, AHMSA announced it would be acquired by the US-based fund, Argentem Creek Partners, for $200 million dollars.

According to sources, Argentem has not provided the committed resources, and AHMSA would still be under Ancira's control.

Operational challenges

As of July 2023, the plant remained non-operational, and employees had gone nine weeks without receiving their salaries.

AHMSA has faced problems with unions, accusations of corruption in political campaigns, and other controversial situations involving its stakeholders.

Production and market share

In 2018, AHMSA had total sales of $66.8 billion pesos and a production capacity of 5.5 million tons of liquid steel per year.

General background

AHMSA was incredibly important for the country, being a leading steel company employing thousands of people and supplying essential material.

Needless to say, the history of AHMSA has been marked by all kinds of controversial episodes in the last 30 years.

Uncertainty and future

The future of AHMSA remains uncertain, and it is expected to continue being a subject of debate.