Glass manufacturing: Vitro

Why didn't minority shareholders like the way it chose to redesign its organization?

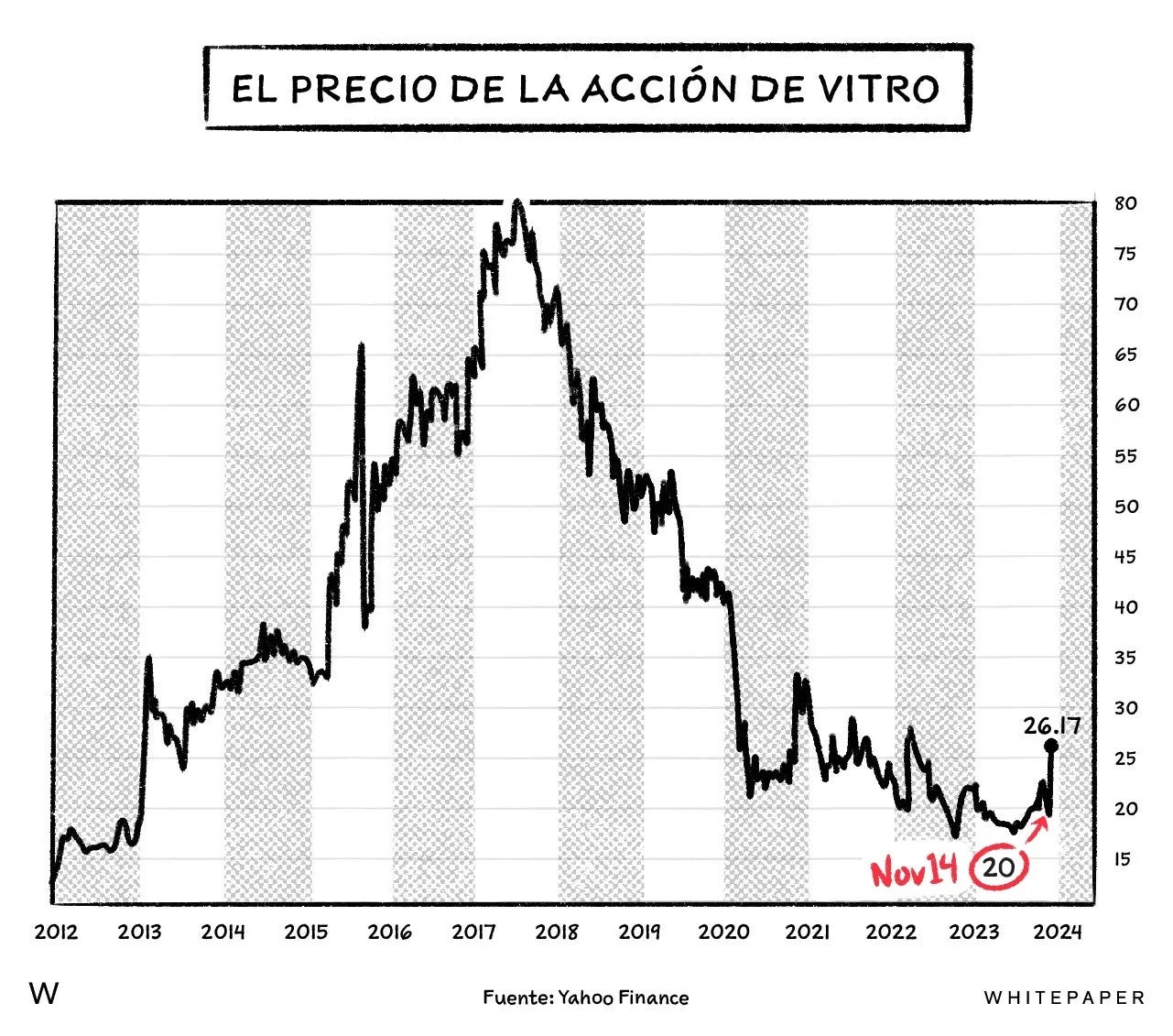

In recent weeks, a significant corporate restructuring proposal by Vitro, a prominent, 100 year old Mexican glass manufacturer, has garnered attention and raised concerns among minority shareholders and market observers alike.

Corporate restructuring details

Vitro proposes a corporate restructuring.

The creation of a new private company in Luxembourg, Vitro Luxembourg.

Payment of a $1.12 per share dividend to existing shareholders.

Shareholders have the option to receive the dividend in cash over 15 years with a 3% interest rate or convert it into shares of the new company.

Vitro Luxembourg acquires 100% of the automotive business and a majority stake in the architectural and packaging businesses.

Don’t forget to subscribe to our weekly newsletter, it’s free!

Minority shareholder reactions

Concerns and discontent among minority shareholders about the restructuring.

Some minority shareholders choose to sell their shares due to uncertainty.

Strategy and impact

The strategy benefits the controlling group.

Questions about the potential impact on the company's reputation and the Mexican stock market.

The restructuring is not positively viewed by minority investors.

Potential implications for business credibility in Mexico and its attractiveness to investors.