Innovative strategies, challenges unique to the Mexican market, and the evolving role of private equity in shaping the country's business landscape.

Private equity fund and acquisitions

Discovery Americas is a private equity fund based in CDMX.

The fund acquired four schools: Colegio Reina Isabel in Tijuana, Baden Powell and Ann Sullivan in the State of Mexico, and Instituto México Americano in Veracruz.

These schools are under the holding company Merited, specializing in acquiring, operating, and growing K-12 private educational centers.

Don’t forget to subscribe to our weekly newsletter, it’s free!

Investment strategy and value generation

Discovery Americas' strategy is to buy, take control, and improve educational companies with the expectation of increasing their total value.

The investment premise is that by unifying standards and capabilities, the group's value will exceed the sum of its parts.

Merited has approximately 3,500 students across the acquired schools.

The fund aims to implement operational improvements, technology enhancements, and alignment with international practices in the acquired companies.

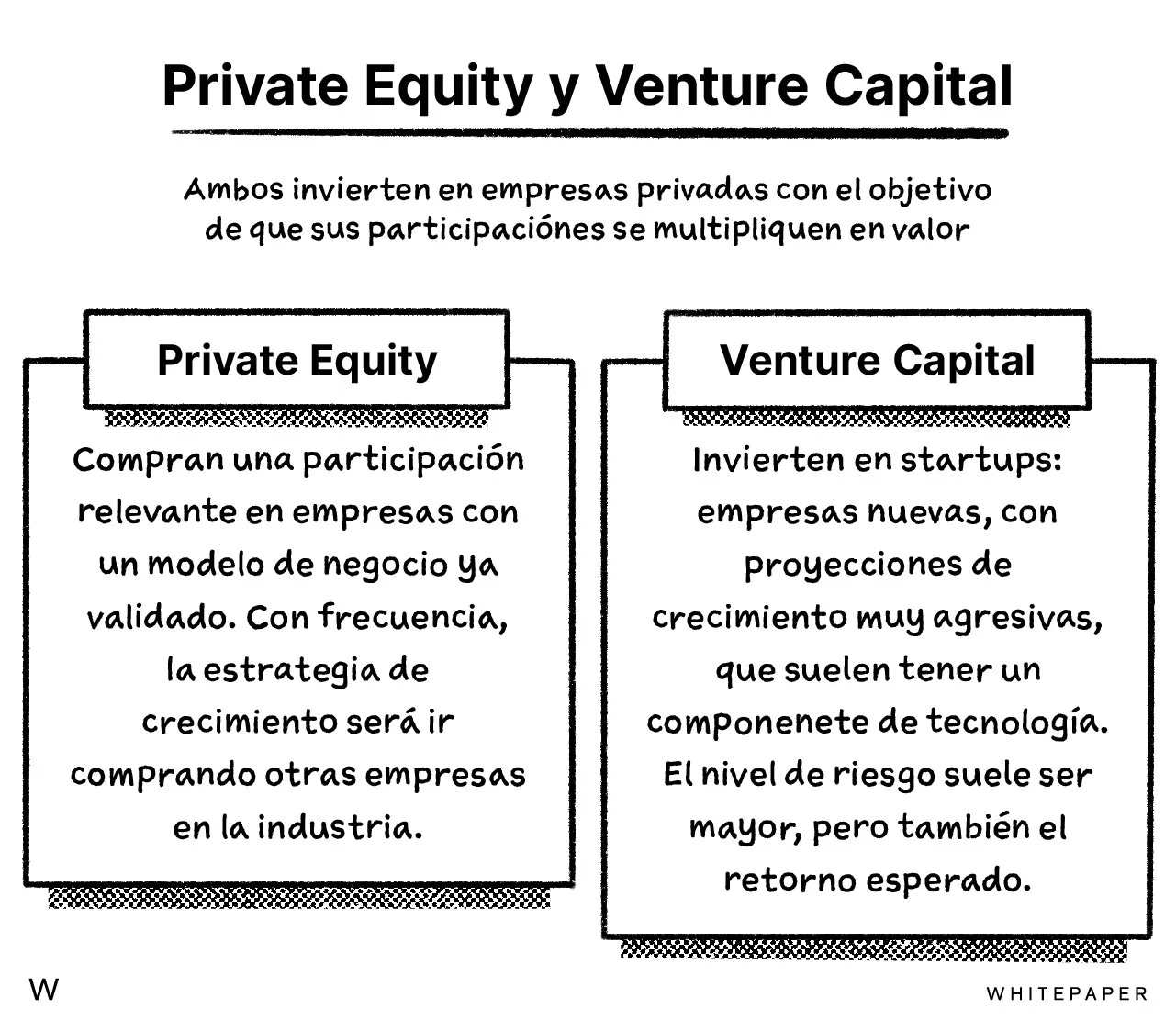

Challenges and focus of Mexican private equity

Private equity in Mexico faces limitations compared to the US in terms of debt access and value generation alternatives.

In Mexico, the primary focus is on increasing cash flows of acquired companies to generate returns for investors. Adding on to that, exits in private equity have been a challenge; IPO and specific buyer sales options are limited.

Investment opportunities in Mexican private equity are centered in sectors like education and health, which can be professionalized and benefit from technology investment.

Role of private equity in Mexican business ecosystem

Despite limitations, private equity plays a significant role in the Mexican business ecosystem, driving improvements and growth in companies.

Credit limitations in Mexico reduce the risk of overleveraging in private equity deals.

While not controlling companies, private equity firms exert significant influence to promote improvements and growth.

That said, private equity in Mexico aims to invigorate business growth, modernize companies, and foster competitive practices.