Taco chains' history: Explained so you may digest it.

Mexican food chains in the US

Del Taco is not the largest Mexican food chain in the US, but it has 600 restaurants in 16 states.

In 2021, Jack in The Box acquired Del Taco for $575 million.

Don’t forget to subscribe to our weekly newsletter, it’s free!

Mexican food chains in Mexico

In Mexico, there are nearly 400 KFC branches, almost 700 Little Caesars, around 300 Carl's Jr., about 375 McDonald's, and over 400 Burger King locations.

However, there are no taco chains in Mexico that come close to these dimensions, especially compared to Mexican food chains in the US.

Well-positioned Mexican taco chains

El Fogoncito is a well-positioned brand with fewer than 20 locations. They launched a crowdfunding campaign in 2019 to grow.

Taquearte had 8 restaurants in 2016, 12 in 2017, and aimed to add 18 new locations by 2018 using a franchise model. As of now, they have 22 locations.

El Tizoncito has 15 locations. Tacos Mode has 4 locations. El Charco de las Ranas has 3. El Califa has 15.

Nexxus Capital's efforts

Nexxus Capital, a private equity firm, aimed to change the situation by building and projecting large restaurant chains. They acquired Taco Inn in 2014 and later purchased El Farolito and other brands.

Taco Holdings, the entity created by Nexxus, accumulated over 484 points of sale and 12 brands, but only around 20% of them were taco shops.

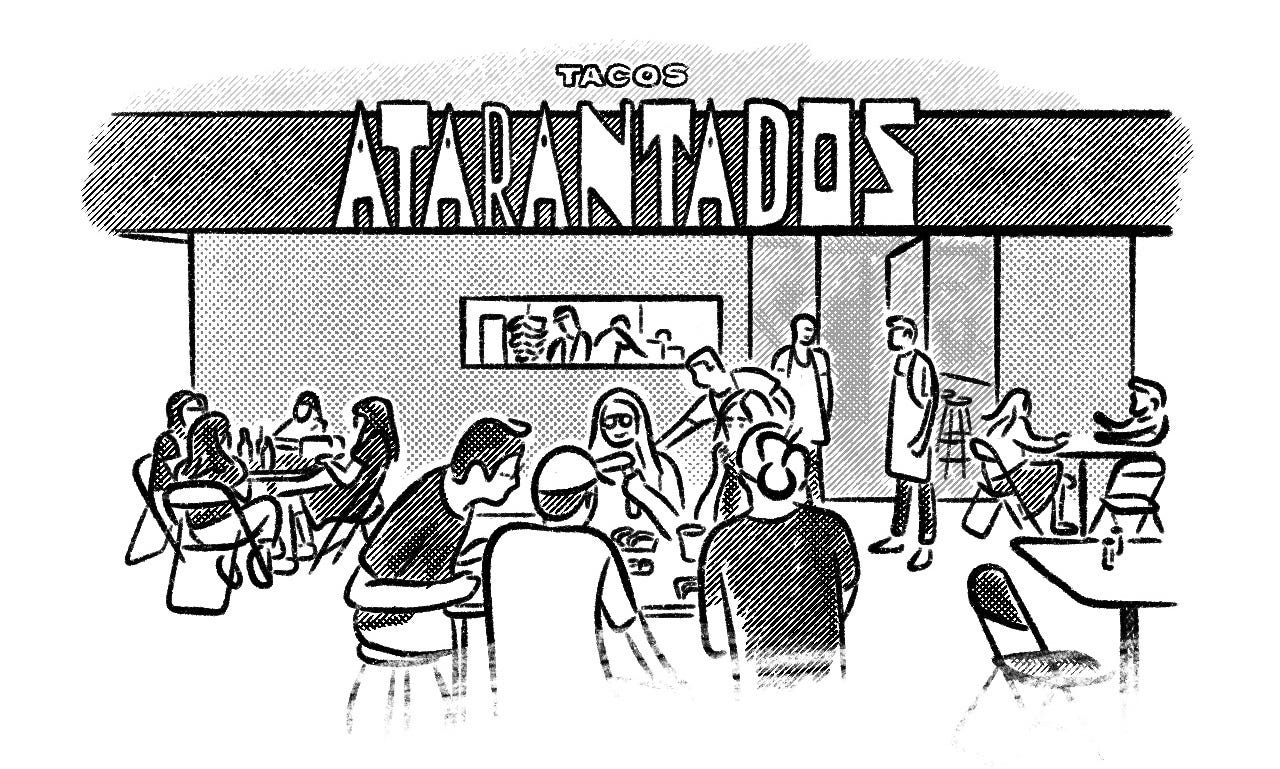

Successful ventures

Tacos Atarantados, part of a new generation of taquerias, is a successful venture with multiple locations and a focus on design and aesthetics.

Tacos Orinoco, with involvement from the renowned design agency Anagrama, has grown in Monterrey and has 4 out of 7 locations in Mexico City.

El Farolito, now owned by Grupo Gigante along with other brands, is considered a profitable business with potential for growth.

O'Sabor, located within OXXO convenience stores, has quietly grown over the years and has over 1,120 taco stations.

Challenges for expansion

According to experts, the profitability and institutionalization of taquerias are major obstacles for expansion.

The informal sector of taquerias, which benefits from tax advantages, poses a challenge for fast-food chains competing on price.

Potential for expansion

Some Mexican taco chains are expanding successfully in the US, creating potential for them to enter the Mexican market as well.

The uncertain future of massive taqueria chains

In conclusion, the possibility of creating a massive taqueria chain remains a question.