Startups like Casai face the pressure to scale quickly, attract investors, and capture market share. This pursuit of growth can lead to increased expenses, liquidity issues, and the need for continuous funding.

Growth and expansion

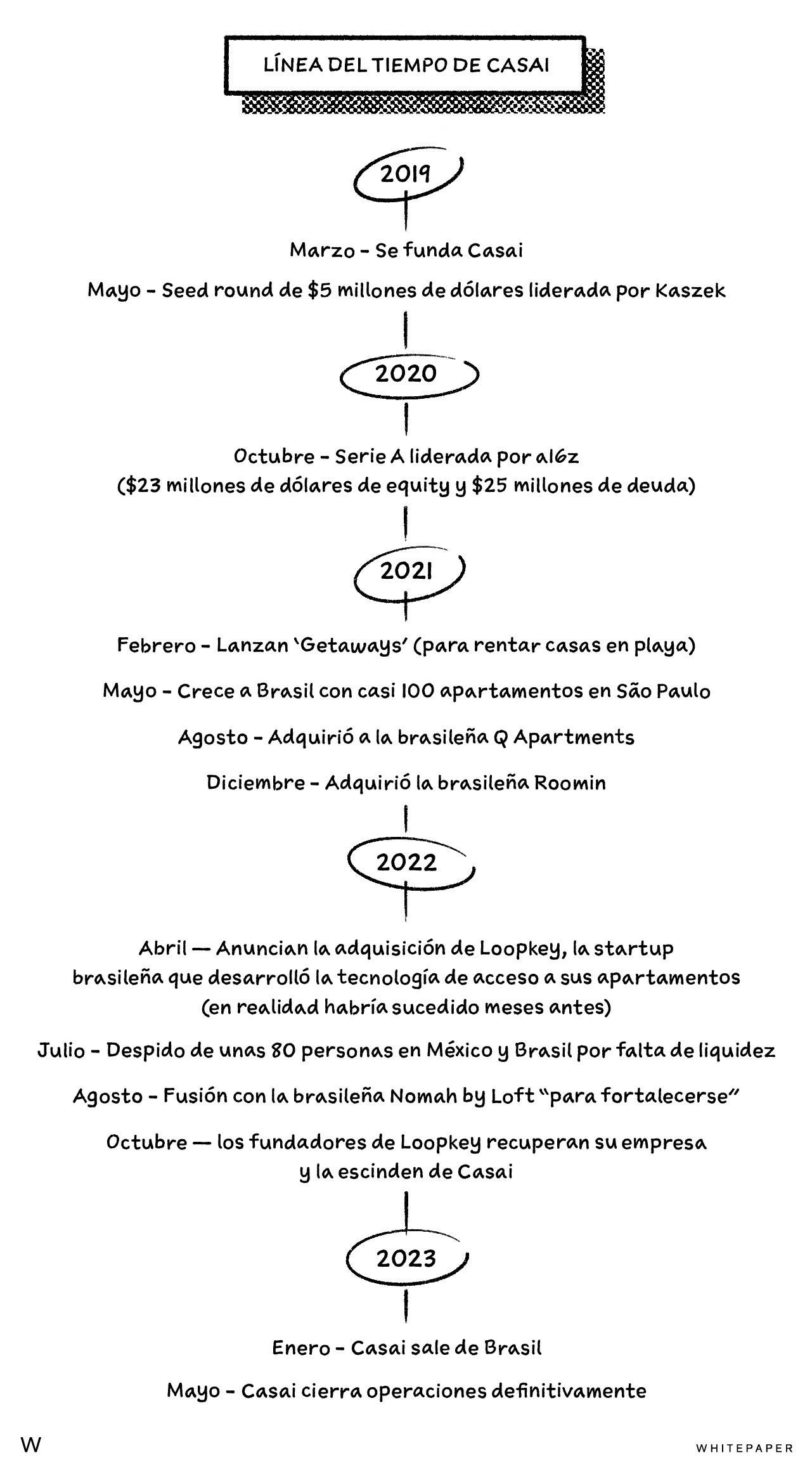

Casai experienced significant growth in 2021, with a fourfold increase in the number of available units and an eightfold increase in booking value.

The company was operating in five cities and launched a new product version called 'Getaways' for renting beach houses.

They acquired a couple of companies in Brazil and expanded their operations in said country.

Don’t forget to subscribe to our weekly newsletter, it’s free!

Available units and investment

By December 2021, Casai had over 800 units available for rent in Mexico and Brazil.

In October 2021, Casai secured a $23 million investment led by Andreessen Horowitz, along with an additional credit line of up to $25 million.

Financial challenges and closure

Despite their growth, Casai faced financial challenges and liquidity issues, leading to the closure of their operations in June 2022.

Competition in the short-term apartment rental market, particularly with the entry of Sonder in Mexico, increased rental costs for Casai.

Casai's business model, which involved significant financial commitments with property owners and investment in technology, became unsustainable.

Despite generating revenue, the company heavily relied on external funding and failed to secure a Series B funding round.

Merger attempt and ultimate closure

Casai attempted to merge with Nomah in an effort to achieve viability, but the merger was unsuccessful.

The company ultimately ceased operations.

Feasibility of exponential growth and financial challenges

The story of Casai raises questions about the feasibility of exponential growth in traditional industries such as real estate.

It highlights the financial challenges startups in this sector face.