Why Mexican airports are such great businesses

An inside look into what makes airports such great businesses... something to think about next time you buy a plane ticket.

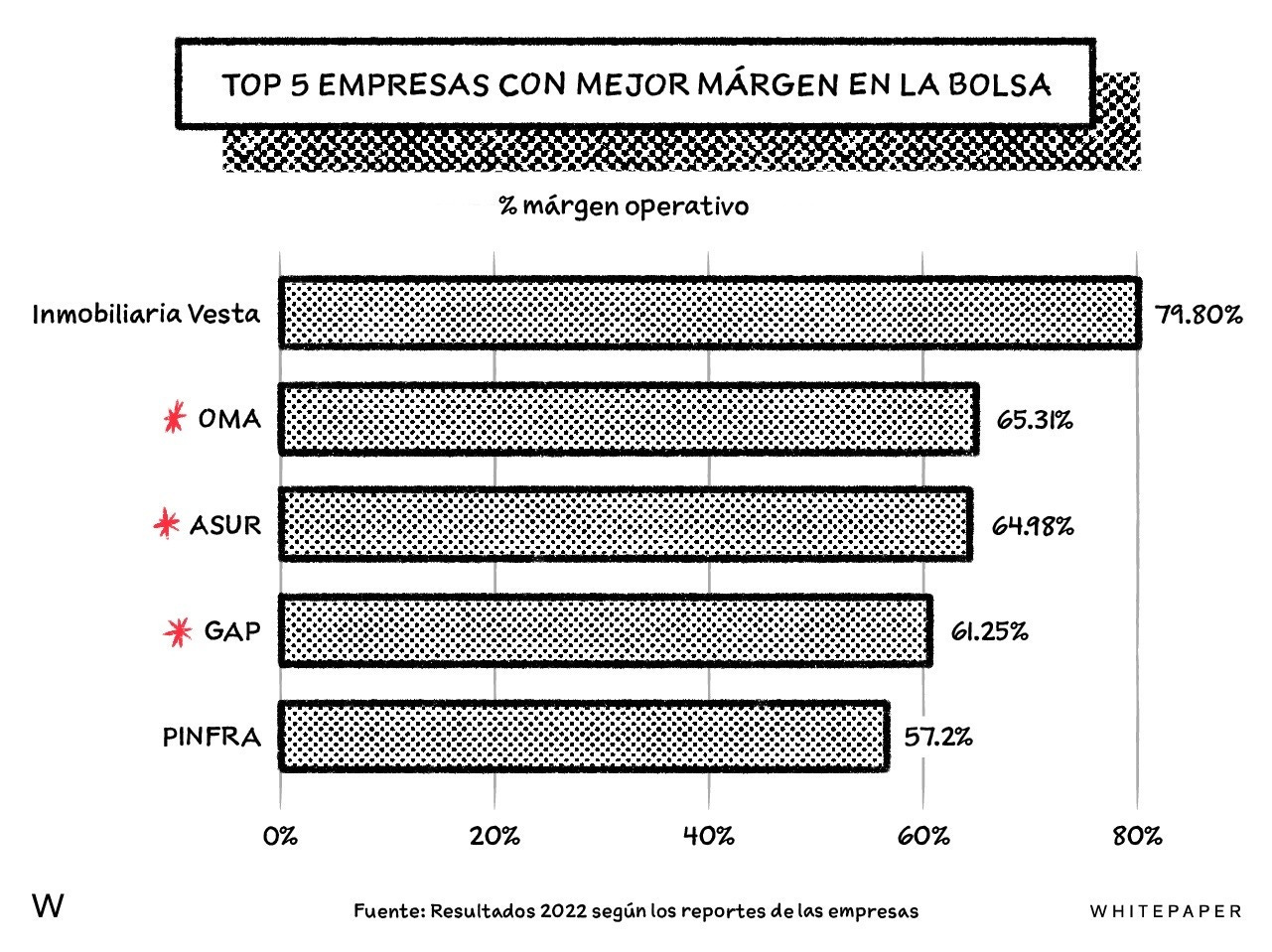

Before we get into the nitty gritty of how Mexican airports operate, it's important for you to keep in mind that there are three privately operated airport groups in Mexico, and they are within the top 5 most profitable public companies.

Privatization of Mexican airports

In the 90s, 34 out of 58 airports in Mexico were privatized and distributed into three different groups: ASUR, GAP, and OMA.

The privatization process involved selling a 15% stake in each group to investors through a public bidding process, followed by an IPO for the remaining shares.

Don’t forget to subscribe to our weekly newsletter, it’s free!

Airport operators and control

The airport operators charge airlines, passengers, and other users certain fees for the use of airport facilities and also generate income from activities such as leasing spaces to businesses.

ASUR is controlled by Fernando Chico Pardo and Grupo ADO, GAP is controlled by Laura Diez-Barroso Azcárraga, Eduardo Sánchez Navarro and Juan Gallardo Thurlow, and OMA was recently sold to Vinci, a French company specializing in managing public concessions.

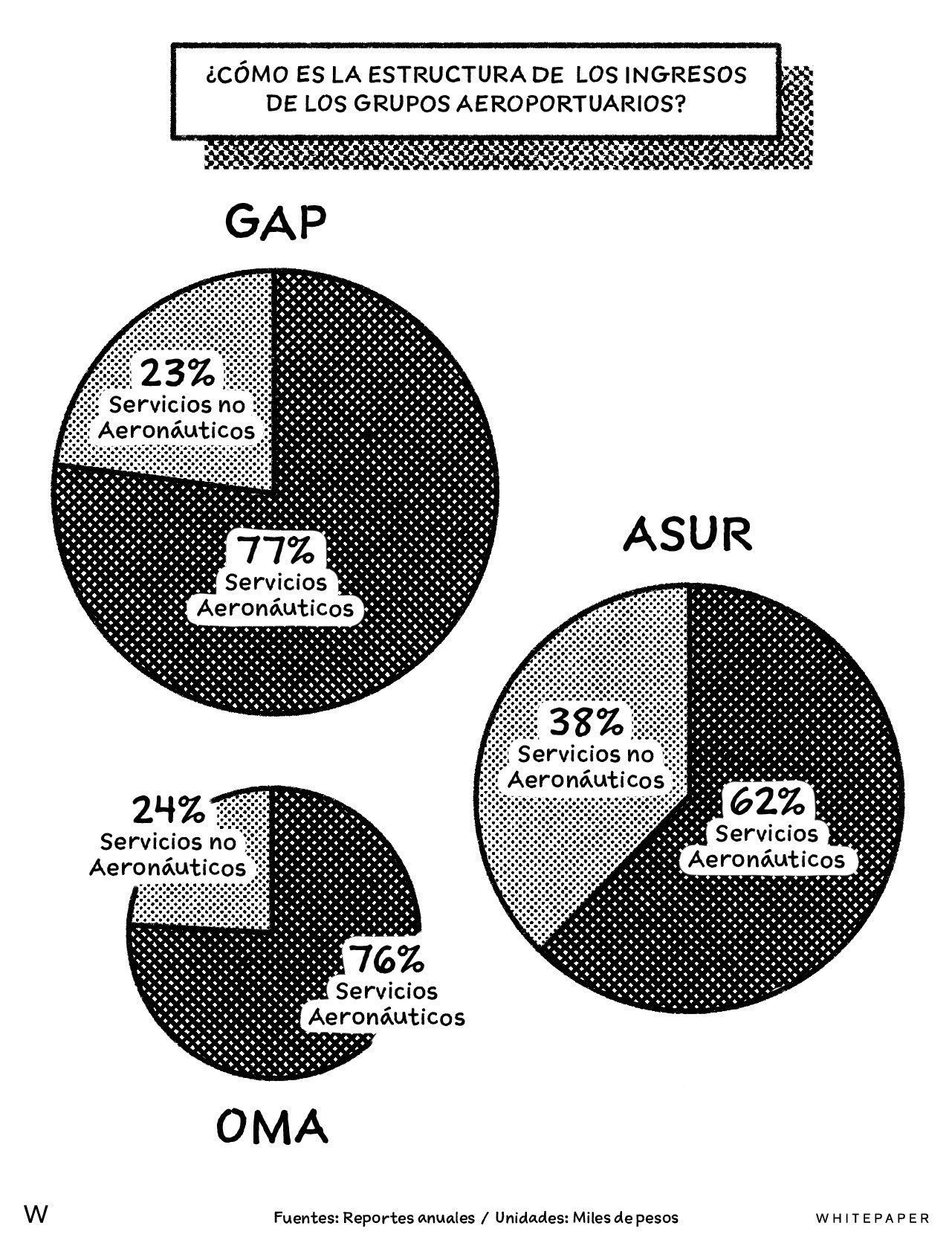

Airport revenue sources

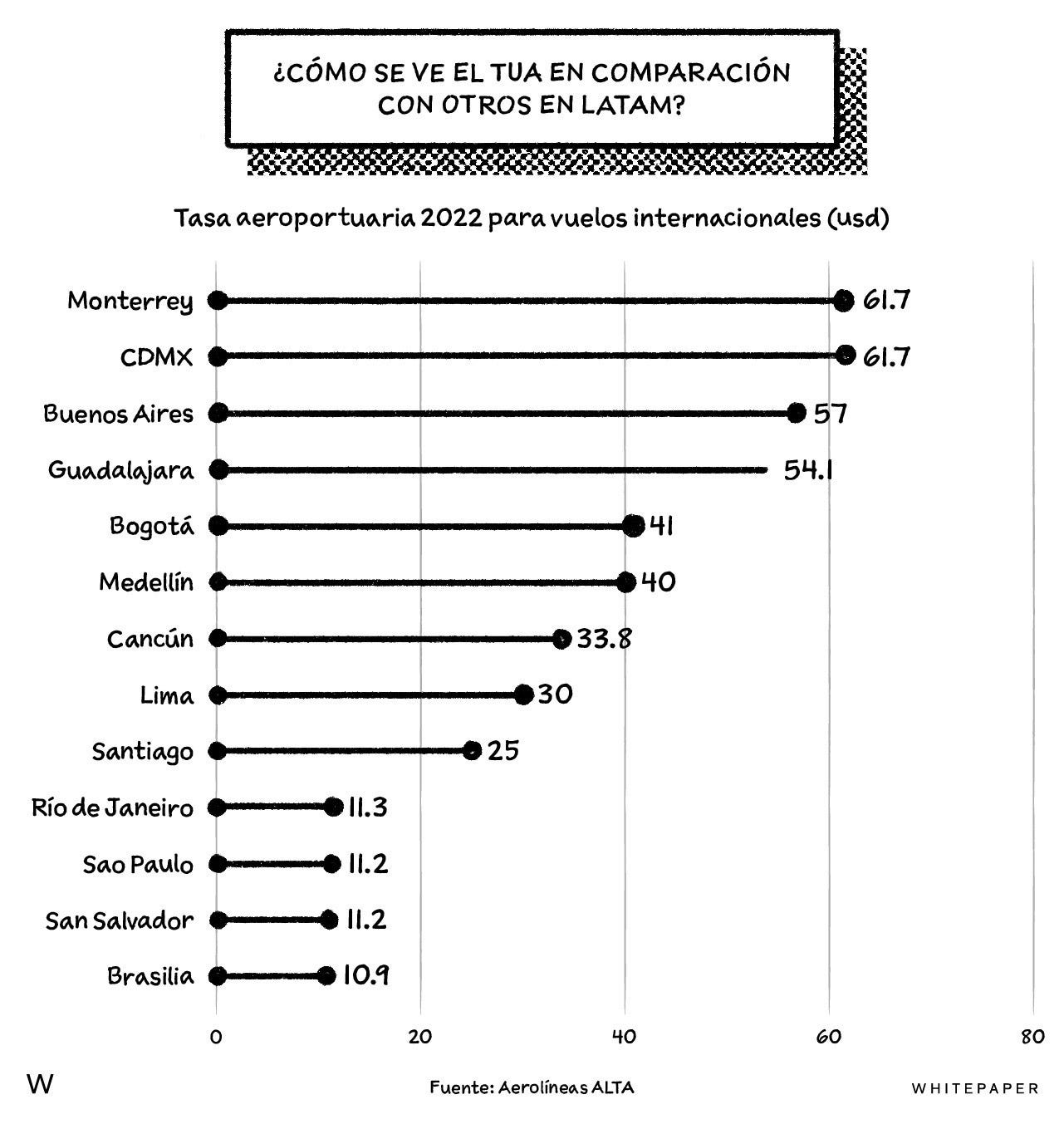

The airport revenue is divided into aeronautical and non-aeronautical services. Aeronautical services include airport usage fees (TUA) paid by passengers and various fees paid by airlines for using the infrastructure.

Non-aeronautical services include income from commercial activities within the airports, such as retail stores and restaurants, which have been growing worldwide.

Profitability and revenue structure

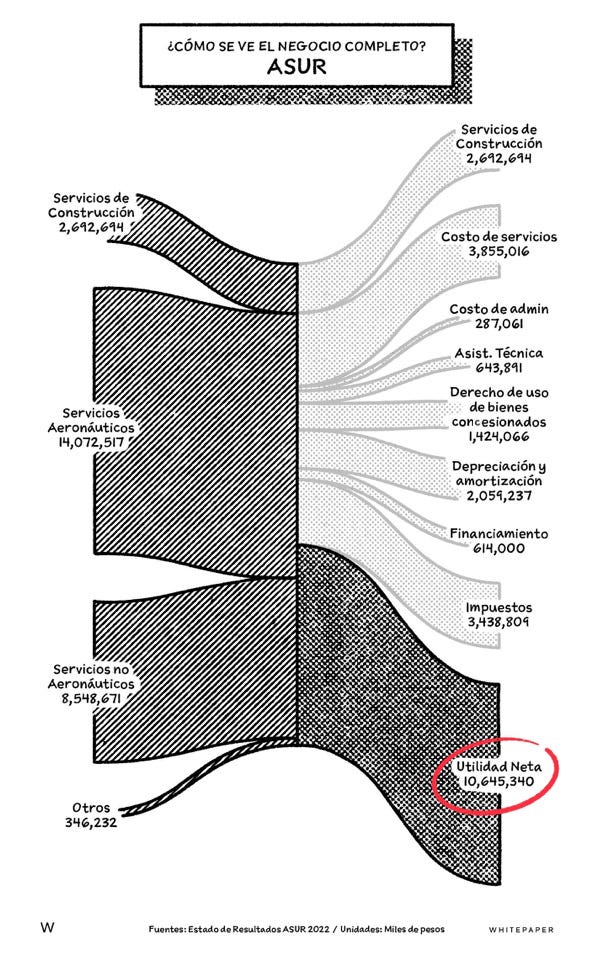

The net profit margin for the airport groups in 2022 exceeded 30% of total revenue, with ASUR leading at 41%.

The profitability of airport groups contrasts with the financial performance of Mexican airlines, which experienced losses in 2022.

The revenue structure of airports combines regulated income with increasingly diversified and significant commercial revenues, while maintaining controlled costs.

Economic contributions of airports

Airports contribute to the development of cities by creating economic benefits, facilitating business clusters, and promoting investment and cultural exchange.

Strengths of each airport group

GAP with Guadalajara and Tijuana airports.

ASUR with Cancun and Mexico's popularity as a tourist destination.

OMA with nearshoring opportunities and capacity of its runways.

Future challenges and opportunities

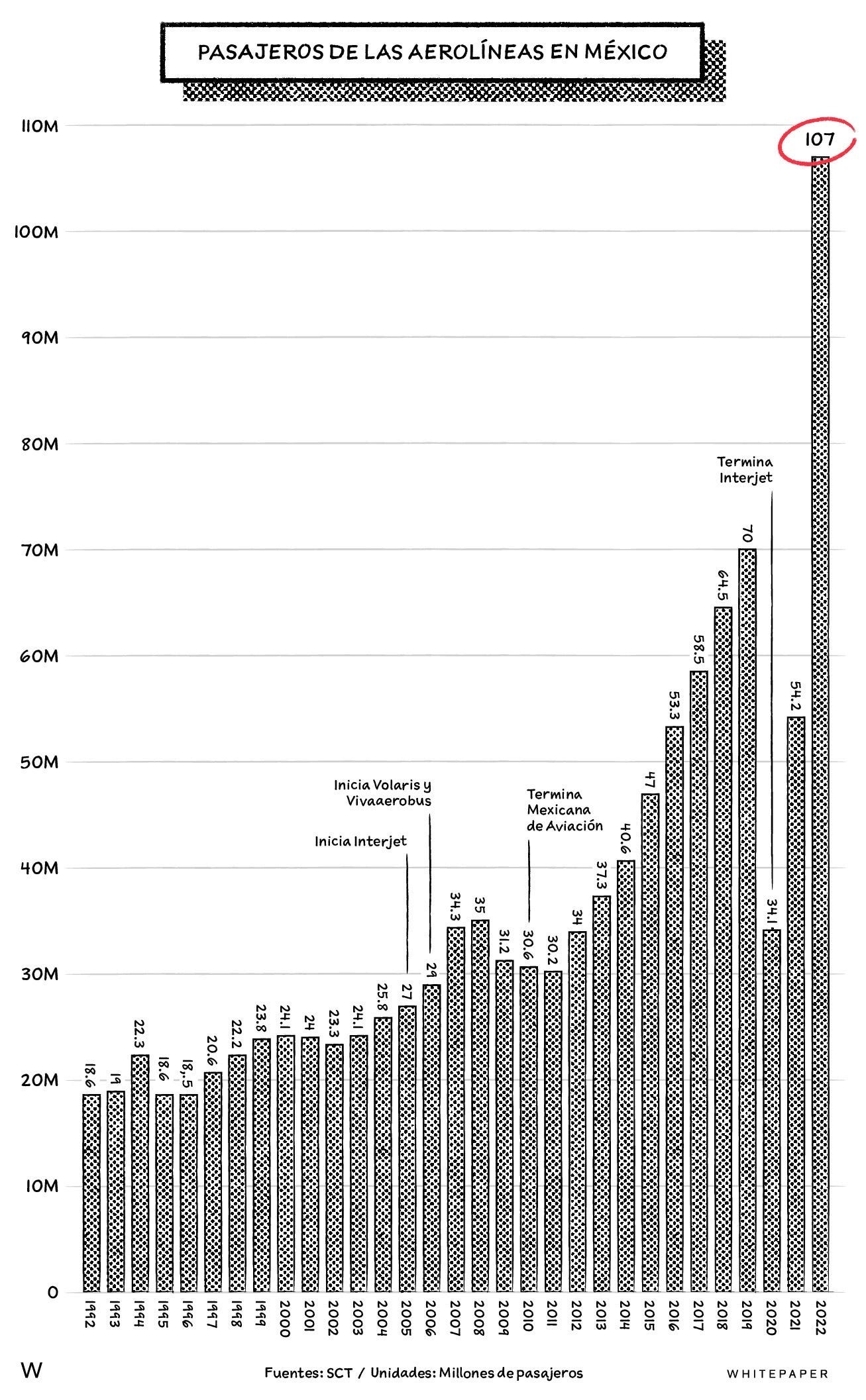

The evolving environment and potential competition pose future challenges for airport groups, but they benefit from the growing aviation industry in Mexico and their unique revenue models.

Profitability and unique attributes

The airport groups operate in a growing environment, have a special income model, limited competition, experienced management teams, and long concession periods, making them highly profitable.